Some of you may be wondering why we choose to study the evolution of economic thought. Is it just out of sheer interest? Or are there deeper reasons? John Maynard Keynes, one of the most highly-regarded economists of our time, said it best.

“A study of the history of opinion is a necessary preliminary to the emancipation of the mind.”

That is to say, without knowledge of the history of economics, we cannot even begin to understand contemporary economics or its relation to modern-day policy. It is for that reason that we are inviting a number of distinguished guests to speak about this very topic at the Marshall Society Annual Conference.

The award-winning labour economist

One of our most renowned speakers is Sir Chris Pissarides. Now a professor at the LSE, his most impressive accolade was being awarded the 2010 Nobel Prize in Economics along with two other labour economists, for their work on search theory in the labour market.

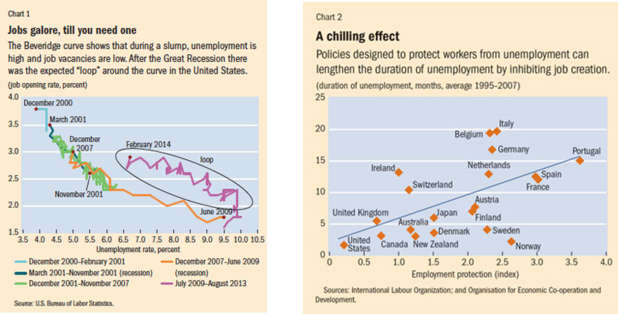

His vital contribution was developing a concept called the matching function whereby the number of vacancies in the labour market was modelled as a function of the number of unemployed, incorporating factors such as the degree of incomplete information, government policies, and external shocks to the market. In fact, it proved crucial when it came to understanding the movements of the labour market in the aftermath of the Great Recession; as the economy came out of recession, although unemployment fell in tandem with a rise in job vacancies, the economy did not recover as quickly as expected as the Beveridge curve looped out to the right, as shown below.

However, his work did not just improve the policymakers’ understanding of the labour market, his work actively helped to shape policy. The DMP model, named after the three Nobel Prize winners, explains that policies designed to protect workers from unemployment may have the effect of reinforcing unemployment. By making it harder to dismiss workers so as to reduce job destruction, it also depresses job creation and makes for a less dynamic labour market with a higher average duration of unemployment.

With the Nobel Prize being awarded in a year when American and European unemployment were at their zenith following the Great Recession, the award to Pissarides and his colleagues was well-deserved.

The ObamaCare architect

Not to be outdone however, is Jonathan Gruber. Named as one of the Top 25 Most Innovative and Practical Thinkers of Our Time” by Slate Magazine in 2011, the MIT professor has been played a big part in helping to write the Affordable Care Act, something that he himself called “the single most important piece of government legislation perhaps since World War II”.

Having spent decades modelling the intricacies of the health-care ecosystem and building up his reputation in health economics, he worked as a technical consultant to the Obama Administration in 2009-10 and worked with both the administration and U.S. Congress to help craft the Patient Protection and Affordable Care Act. Despite being highly controversial, the ObamaCare act has survived several repeal attempts and has been noted for its effect in reducing the uninsured rate in the US.

The guardian of the financial system

Knighted for his services to central banking, Sir Paul Tucker has spent most of his life staving off financial crises and ensuring financial stability. With 33 years of experience at the Bank of England, he has always had his finger on the British economy’s pulse.

In particular, he received great praise for his role as Executive Director for Markets during the financial crisis of 2007-8 when he led the charge in urging the central bank to provide emergency lending to help shore up liquidity shortages in the banking system. This resulted in the creation of the Special Liquidity Scheme under which the Bank of England lent £185bn of Treasury bills to 32 UK banks and building societies, and was subsequently dubbed as ‘the single most successful crisis response deployed in the U.K’ by the Wall Street Journal.

Having left his role as Deputy Governor of the Bank of England for Financial Stability in 2013, just under a month ago, he took on a new job as chair of the Systemic Risk Council. An independent organisation that monitors and encourages regulatory reform to help mitigate systemic risk across global capital markets, it further demonstrates his commitment to safeguarding the stability of the global financial system.

The happiness expert

Also an expert in the field of labour economics is Professor Richard Layard. As a Programme Director at the LSE’s Centre for Economic Performance, he has been responsible for exploring the causes of happiness.

On top of regularly co-editing the Annual Happiness Reports, he and his colleagues on the Wellbeing research programme released a highly controversial paper in 2014, looking into what leads people to be satisfied with their life. Despite the traditional wisdom being that academic achievement as a child or income are critical to achieving happiness later in life, the paper stressed the importance of one’s “emotional health”. In fact, the paper completely dismisses the importance of income as it “only explains about 1% of the variation in life satisfaction among people in the UK”. It is for this reason that Layard proposes that countries should be focused not on GDP but on GWB, general well-being.

With the conference set to take on the 30th Jan, our distinguished guests will have a great deal to discuss so make sure not to miss out! For more information, visit this link.